What Is an Insured Mortgage and How Does It Work?

If you're buying a home with less than 20% down, you'll need something called an insured mortgage. Many borrowers find this confusing at first, especially since it doesn’t refer to insurance for you, the borrower. That’s why I have put together this straightforward breakdown so you understand what insured mortgages are, why they exist, and how they affect your purchase.

What Is an Insured Mortgage?

A mortgage must be insured when a borrower makes a down payment of less than 20% on a home purchase. The insurance protects the lender (not the borrower) in case the borrower defaults. The insurance is guaranteed by the federal government.

So, why do we have this program? It allows borrowers to buy homes with smaller down payments and higher loan-to-value (LTV) ratios. Higher loan-to-value mortgages are inherently more risky because there is not much cushion if the housing market starts to decline.

For example, if someone buys a $500,000 home with only 5% down ($25,000), they’ll need a $475,000 mortgage—this is a 95% LTV. If the market drops and the home’s value falls to $470,000, the mortgage would still be $475,000. If the borrower stopped making payments, the lender could lose money after selling the home and paying costs.

That kind of loss, multiplied across thousands of borrowers, could threaten the stability of the entire banking system (as we saw in the U.S. in 2008). The mortgage insurance system is designed to prevent that scenario by spreading risk and keeping lenders protected.

How Does the Insurance Work?

You, the borrower, pay the insurance premium. It's typically added directly to your mortgage balance rather than paid upfront. The cost depends on your down payment size and amortization.

Example:

- Purchase price: $500,000

- Down payment: $25,000 (5%)

- Mortgage amount: $475,000

- Insurance premium: 4.2% = $19,950

- Total new mortgage: $494,950

The insurance does add cost, but insured mortgages usually offer slightly lower interest rates because the lender's risk is minimal. The rate savings don't fully offset the premium, but they help.

The Insurer’s Role

For insured mortgages, the insurer’s approval is the most important part of the process. If the insurer won’t approve the file, no lender can. Once the insurer signs off, we can typically find a lender to fund the loan.

Canada has three mortgage insurers:

- CMHC (public)

- Sagen (private)

- Canada Guaranty (private)

All of the insurers are backed by government guarantees and have to follow similar rules, but each has a few unique programs. Lenders usually choose the insurer, though I sometimes work with them to send a file to a specific insurer if it benefits the borrower.

Qualification Rules

Because insured mortgages are government-backed, the rules are strict:

- Debt ratios:

- 39% of your income can go toward your stress-tested mortgage payment, property taxes, heat, and half of condo fees

- 44% of your income can go toward the above plus your other debts

- Down payment: 5% on the first $500,000, 10% on the remainder

- Maximum purchase price: $1.5 million

- Amortization: Maximum of 25 years for most buyers; up to 30 years for first-time buyers who qualify under the new federal program

Unlike with an uninsured mortgage, where lenders may have some flexibility if your income ratios are slightly above the limits, there is no discretion on an insured mortgage. If your ratios exceed the limits even a little bit, the insurer will decline the application.

The Approval Process

The process is similar to an uninsured mortgage, with one extra step:

- We submit your mortgage application to the lender of choice

- They do their initial review

- If that looks good, they package it up and send it to the insurer

- Once the insurer has reviewed and approved it, the file comes back to the lender for final review and approval

Common Misunderstandings About Insured Mortgages

Many borrowers are surprised to learn the following facts about insured mortgages:

- You do not need to be a first-time homebuyer to buy with less than 20% down

- You cannot buy an investment property with less than 20% down

- You can buy a second home with less than 20% down

- You cannot refinance an insured mortgage and keep the insurance. If you have an insured mortgage and do refinance, you will lose the insurance. This mostly affects the lender, but it also moves you to uninsured rates.

Why Choose an Insured Mortgage?

Given the cost and restrictions, why would anyone choose an insured mortgage?

The main reason is accessibility. It allows you to buy a home without saving a full 20% down payment, which is increasingly difficult with high home prices and living costs.

It can also be a strategic choice. Some buyers prefer to keep more of their savings invested or diversified instead of tying everything up in a down payment. If your investments are earning more than your mortgage costs, keeping that money invested might make financial sense.

Real-World Example

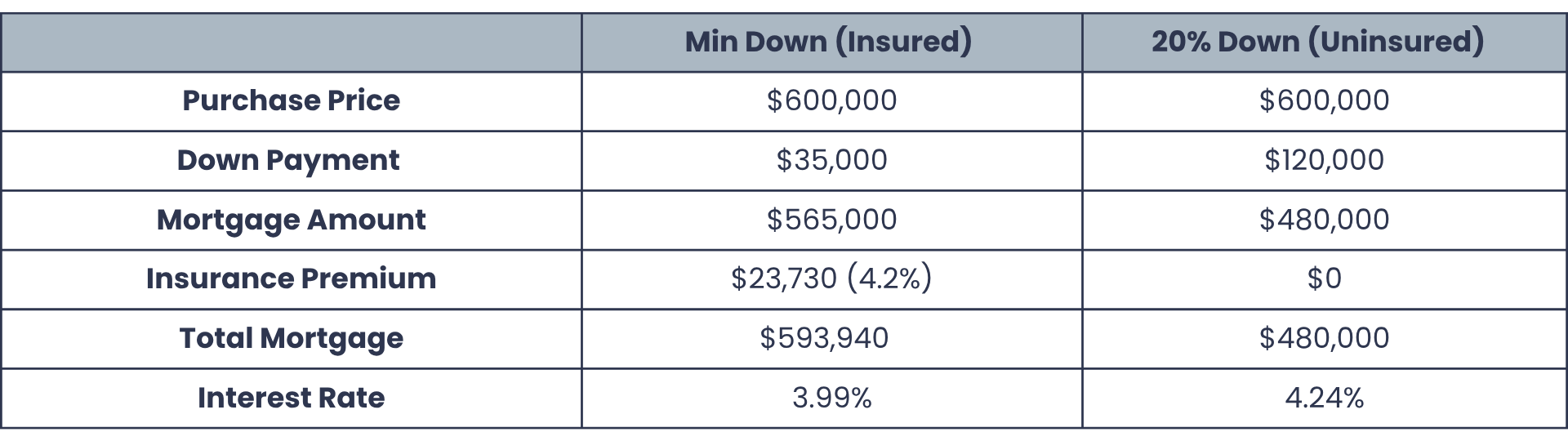

Let's say you're buying a $600,000 home. Here's how the costs compare between the minimum down payment for an insured mortgage and the minimum down payment for an uninsured mortgage:

With the insured mortgage, you need $85,000 less upfront, but your monthly payment is $448 higher due to the larger loan and added premium. The trade-off is accessibility: you can buy the home sooner without needing to save an additional $85,000.

Quick Summary

- Insured mortgages: required when you put down less than 20% on a home purchase

- Insurance cost: Added to your mortgage; protects the lender, not the borrower.

- The premium: typically 2.8% to 4.2% of the mortgage amount and gets added to your loan

- Strict rules: Government limits on debt ratios, purchase price, and down payment.

- Three insurers: CMHC, Sagen, and Canada Guaranty.

- Maximum purchase price: with an insured mortgage is $1.5 million

- Interest rates: on insured mortgages are typically 0.10% to 0.30% lower than uninsured mortgages

- Main benefit: Enables homeownership with a smaller down payment.

Next Steps

If you're considering buying a home with less than 20% down, I can walk you through the exact costs and qualification requirements based on your situation. I'll show you what your insurance premium would be, what your monthly payments would look like, and whether an insured mortgage is the right choice for you.

Need help with your mortgage? Book a consultation or call 778-988-8409.

Glossary

Amortization: The length of time it will take to pay off your mortgage in full.

Default: When a borrower stops making mortgage payments and fails to meet the terms of their loan agreement.

Down Payment: The initial cash payment you make when purchasing a home, expressed as a percentage of the purchase price.

Insured Mortgage: A mortgage that requires default insurance because the down payment is less than 20% of the purchase price.

Loan-to-Value (LTV) Ratio: The percentage of the home's value that you're borrowing. A $475,000 mortgage on a $500,000 home is a 95% LTV.

Refinance: Replacing your existing mortgage with a new one, often to access equity or change terms.

Stress Test: The federal rule that requires you to qualify at a higher interest rate than your actual rate, ensuring you can afford payments if rates increase.

Uninsured Mortgage: A mortgage where the down payment is 20% or more, so default insurance is not required.